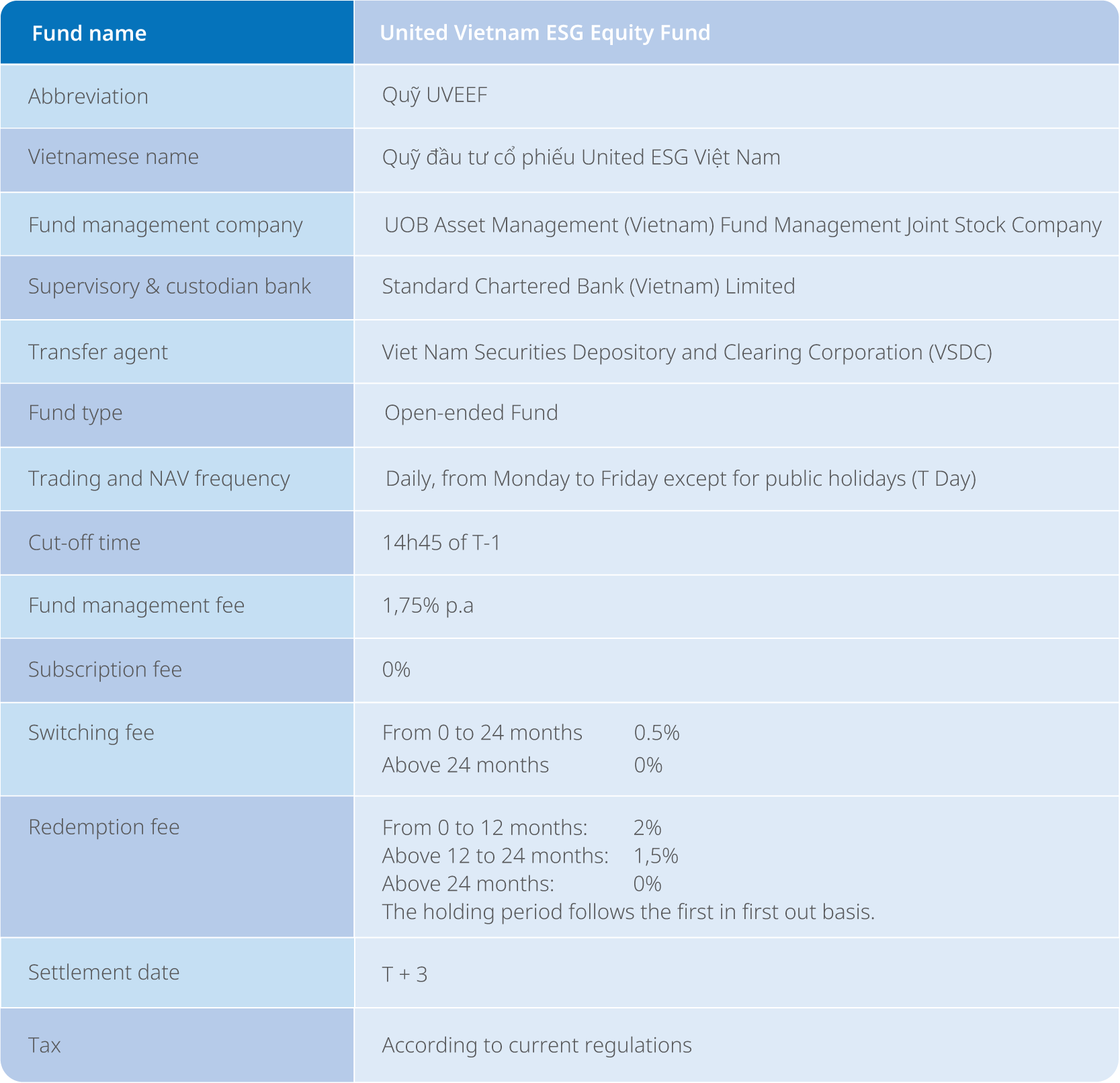

The investment objective of the United Vietnam ESG Equity Fund (UVEEF) is to pursue long-term capital growth through building a balanced and diversified portfolio of stocks of companies listed on the Vietnam stock market with following characteristics:

- Leading companies in respective sector, good fundamentals and sustainable long-term growth prospects, good stock liquidity;

- Comply with ESG standards (*) and have good ESG score by UOBAMV Investment team. The UVEEF aims to promote good practice by companies toward ESG standards to improve competitiveness and sustainable development. Thereby, it will increase the value of these companies and contribute to the increase in value of the investments of the UVEEF.

(*) ESG: stand for Environment (E), Social Responsibility (S), and Corporate Governance (G). ESG is a set of standards to evaluate the sustainable development of a company in addition to the traditional important goal of maximizing corporate profits.

Investment strategy

The UVEEF adopts an investment strategy that flexibly combines the philosophy of value investing and growth investing. Specifically, the UVEEF focuses mainly on industries and companies that benefit from Vietnam's economic growth, favorable demography, strong domestic demand and the wave of FDI inflow into Vietnam.

(*) Note:

- Investors need to transfer the amount registered to buy fund units from the bank account in the Investor's name by ordinary transfer. Subscription orders transfered to the Fund's account from E-wallet will be rejected.

- Transfer fee to buy fund units and Transfer fee to sell fund units to investors is made according to the fee schedule of the Bank and paid by the investor.

- Money from selling fund units (after deducting redemption service price and tax) will be refunded to Investors by the Fund Management Company at T+3. Remittance fee from the sale of fund units to the Investor's account will be deducted from the proceeds of the redemption of fund units.

- Money from selling fund units will be transferred to the bank account which is initially registered in the Open-Ended Fund Account Opening And Investor Information Form.

- Investors are kindly requested to consult the Fund's Charter and Prospectus before making an investment.

- Mr. Do Thanh Tung, CFA – Independent Member, Chairman

- Ms. Thieu Thi Nhat Le – Vice chairman

- Mr. Ly Trung Thanh – Independent member

- Mr. Le Tien Dat – Independent member

- Mr. Le Thanh Hung, CFA - Chief Investment Officer

- Ms. Nguyen Hong Nhung , CFA – Portfolio Manager

The document is for general information only. It does not constitute an offer or solicitation to deal in fund certificates in the Fund (“Fund Certificates”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management (Vietnam) Fund Management Joint Stock Company (“UOBAM (Vietnam)”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM (Vietnam). The value of Fund Certificates and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Fund Certificates involve risks (market risk, inflation risk, interest rate risk, exchange rate risk, market price volatility risk, regulatory risk, strategic risk, investment restriction risk, valuation risk , payment risk, liquidity risk, conflict of interest risk, force majeure risk), including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by UOBAM (Vietnam) or any related entity (“UOB Group”) or distributors of the Fund. To the fullest extent permitted by the applicable laws, the UOB Group may have interests in the Fund Certificates and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus and pay attention to service charges when trading Fund Certificates, which is available and may be obtained from UOBAM (Vietnam) or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Fund Certificates, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Fund Certificates must be made on the application forms accompanying the Fund’s prospectus.