Sustainability

At UOB Asset Management, we drive sustainability by putting environmental, social and governance (ESG) impact at the heart of our business. Find out how we can help you achieve both profit and purpose by investing for good.

At UOB Asset Management, we drive sustainability by putting environmental, social and governance (ESG) impact at the heart of our business. Find out how we can help you achieve both profit and purpose by investing for good.

Investors are increasingly applying non-financial factors as part of their analysis process to identify material risks and growth opportunities.

Socially Responsible Investing (SRI) – an earlier model typically using value judgments and negative screening to decide which companies to invest in.

ESG investing – grew out of the SRI investment philosophy and as a more modern take, involves looking at finding value in companies—not just at supporting a set of values, by incorporating intangibles into traditional financial analysis.

ESG – stands for Environmental, Social, and Governance and summarise a variety of factors that are financially material to businesses, and these include (but are not limited to):

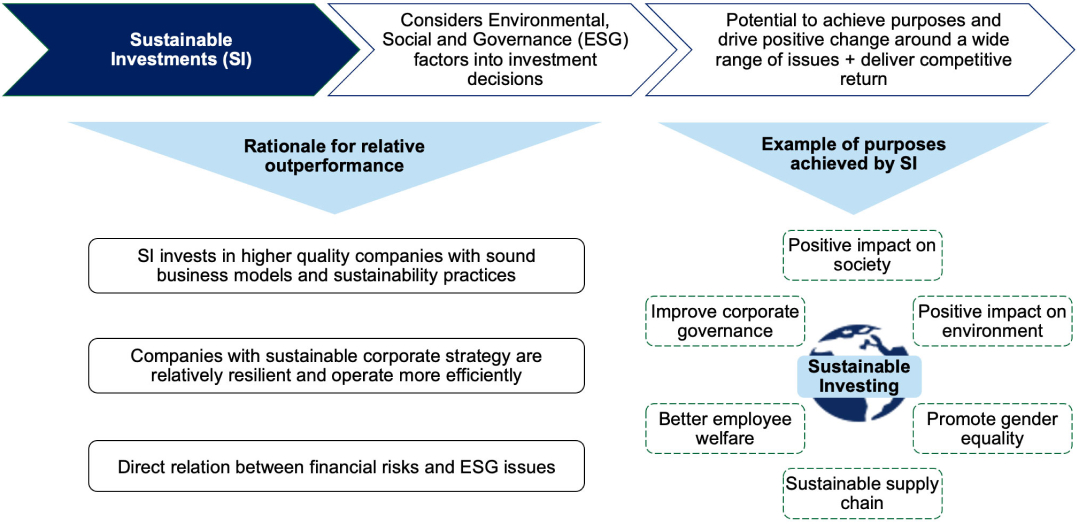

From an investment standpoint, the integration of ESG within an investment strategy helps to form the foundation of what we term as ESG Investing. In general, due to its popular adoption by asset owners and managers, ESG investing has become synonymous with sustainable investing.

Sustainable investing has evolved to encompass both SRI and ESG Integration and can also be taken to mean several other strategies including:

Negative Screening and Ethical Exclusions – The process of filtering out those companies that harm people or the planet. For instance, investors might exclude those related to arms, fossil fuels, tobacco and animal testing.

Thematic and Impact Investment – Active and deliberate investment in assets due to their business purpose fulfilling a positive impact on society or environment, as is the case for example in renewable energy, clean technology and diversity and education, or investing toward the United Nations’ Sustainable Development Goals (SDGs).

Responsible Investing – similar to sustainable investing in the sense of both being the allocation of capital to investments which are sustainable. In general, when one refers to one, they also mean the other.

At UOB Asset Management (UOBAM), our vision is to be a leading fund manager in sustainability in Asia that creates long-term value and positive impact for our stakeholders whilst enabling sustainable investments accessible for all.

As an active asset manager, UOBAM believes that it has a fiduciary duty to allocate capital into more sustainable investments and be active owners of our investments and as a signatory to the United Nations Principles for Responsible Investment (PRI), we are committed to adopting and implementing the principles and reporting on our progress towards their implementation. To enable this outcome, UOBAM has made sustainability a key strategic pillar of the firm which helps to drive our commitment and purpose towards creating value for our investors and communities as well as helping them achieve their sustainable investment goals and aspirations.

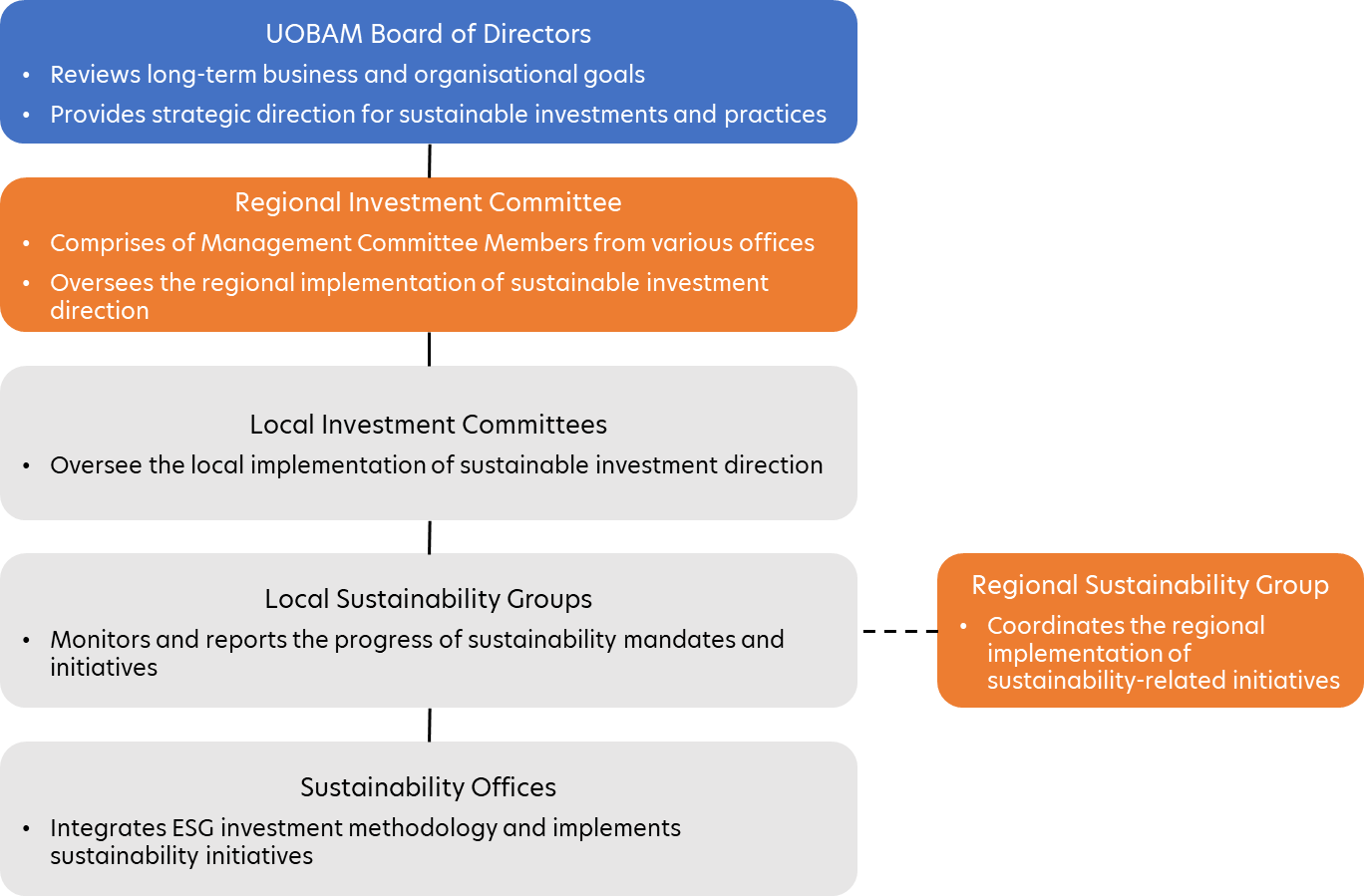

Our sustainability governance structure provides oversight and accountability on the implementation of our responsible investment policy. Our UOBAM Board of directors through the Management Committee (MC), reviews long-term business and organisational goals and provides the strategic direction for UOBAM’s sustainable investments and sustainability practices. The MC manages the implementation of strategic direction that is handed down by UOBAM’s Board of Directors and will be supported by our Regional Sustainability Group (RSG), Local Sustainability Group (LSG), and dedicated Sustainability Offices (SO).

The RSG reports directly to the MC on sustainable investing matters and is made up of the Sustainability Chairs and Champions from each regional office. The RSG coordinates with MC to guide the regional implementation of our sustainable investment mandates as well as sustainability initiatives.

The LSG at each office is supported by dedicated Country SO to monitor and report on the progress of our sustainability activities and mandates. The Country Sustainability Champions take the lead in our corporate sustainability activities, which include ESG product and solution launches, thought leadership and events, sustainability staff training, and corporate sustainability stewardship programmes, and Dedicated ESG Investment Specialists leading their respective offices in implementing our sustainable investing framework.

UOBAM’s dedicated regional SO incorporated into the overall investment organization structure supports our sustainability governance structure with the integration of our ESG investment methodology and implementation of strategic sustainability initiatives. The SOs, each comprising the country’s ESG Champion, a dedicated ESG Investment Specialist and Investment Team. These teams possess local expertise and on-ground engagement through the utilization of dedicated ESG resources to execute engagement for companies in the portfolio in the event of a controversy or to determine specific ESG information. Dedicated ESG resources also provide manual ESG scoring coverage on companies that are not covered by major third-party ESG data providers.

The Singapore Sustainability Office and Centre of Excellence (SOCE) works in close collaboration with all UOBAM regional SOs in order to ensure that companies managed in the portfolio are well positioned for secular growth and alpha generation. The SOCE utilises UOBAM’s integrated ESG management system to facilitate two-way data transfer and to obtain ESG coverage from regional offices, whilst simultaneously delivering real-time updates on the ESG performance of companies, as well as news alerts, to ensure that controversies detected can be followed up with engagement action. The SOCE also develops the governance controls and systems in place to ensure the implementation of UOBAM’s Sustainable Investment policy and corporate and communications plans.

We believe that responsible investment practices can have significant contribution to the development of a more sustainable financial system that benefits the wider community.

Sustainable investing balances traditional investing fundamentals with environmental, social, and governance (ESG) integration to improve long-term performance. Integrating ESG serves as a positive value-added filter to identify higher quality companies that are more resilient and better prepared to meet future challenges.

Our technological edge in ESG integration lies in augmentation with the support of Artificial Intelligence-Machine Learning (AI-ML) models, which aids in constructing ESG investment portfolios using data inputs and analyst evaluation.

As leaders in responsible investing and active owners, UOBAM leverages our regional footprint and local expertise to enhance the ESG evaluation of our companies.