Sustainability is about meeting the needs of the present generation without compromising the ability of future generations to meet theirs. We believe that responsible investment practices can have significant contribution to the development of a more sustainable financial system that benefits the wider community.

Sustainable investing balances traditional investing fundamentals with environmental, social, and governance (ESG) integration to improve long-term performance. Integrating ESG serves as a positive value-added filter to identify higher quality companies that are more resilient and better prepared to meet future challenges.

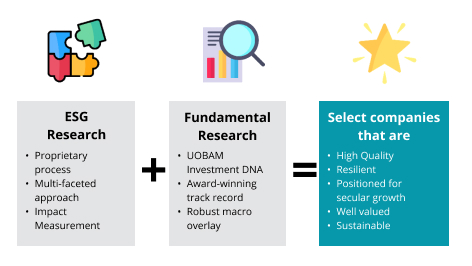

Our technological edge in ESG integration lies in augmentation with the support of Artificial Intelligence-Machine Learning (AI-ML) models, which aids in constructing ESG investment portfolios using data inputs and analyst evaluation.

As leaders in responsible investing and active owners, UOBAM leverages our regional footprint and local expertise to enhance the ESG evaluation of our companies.

We believe that Environmental, Social, and Governance (ESG) issues are financially material to a company’s long-run performance, and that they factor into performance enhancement and risk mitigation. ESG integration enables us to identify high-quality companies which are resilient, well-managed, able to grow sustainably and are likely to maintain their competitiveness in the long term. As such, we integrate Environmental, Social, and Governance (ESG) evaluation into our investment process through our sustainable investing framework that applies across all investment asset classes.

The information contained in the UOBAM Vietnam website is for general information purposes only. The information is provided by UOBAM Vietnam and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance the user places on such information is therefore strictly at the user’s own risk.

The dissemination of the information in this website may be subject to or restricted by laws and regulations in particular jurisdictions. This information is not intended to be published or made available to any person in any jurisdiction where doing so would result in contravention of any applicable laws or regulations. The user should ensure that the use of this information and the making of any investment as a result does not contravene any such restrictions. It is the user's responsibility to be informed and to observe all applicable laws and regulations of any relevant jurisdiction.

The information contained within this website does not constitute an offer or solicitation to sell shares or units in any of the investments referred to, by anyone in any jurisdiction in which such offer, solicitation or distribution would be unlawful or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation. Any user distributing information taken from this site, in whatever form, to any other person, agrees to attach a copy of this page and obtain the agreement of such other person to comply with the terms set forth on this page.

Through this website the user is able to link to other websites which are not under the control of UOBAM Vietnam Fund Management JSC. We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

UOBAM (Vietnam), its affiliates, related companies and its respective directors and employees accept no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein or further communication thereof, even if UOBAM Vietnam or any other person has been advised of the possibility thereof. The user should remember that past performance is not necessarily indicative of future results. The user should seek financial and professional advice regarding the appropriateness of investing in any investment strategy or security discussed.

Every effort is made to keep the website up and running smoothly. However, UOBAM Vietnam takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Copyright 2021 UOBAM Vietnam. No part of this website may be reproduced or distributed without the prior written consent of UOBAM Vietnam. All rights reserved.

Investors are increasingly applying non-financial factors as part of their analysis process to identify material risks and growth opportunities.

Socially Responsible Investing (SRI) – an earlier model typically using value judgments and negative screening to decide which companies to invest in.

ESG investing – grew out of the SRI investment philosophy and as a more modern take, involves looking at finding value in companies—not just at supporting a set of values, by incorporating intangibles into traditional financial analysis.

ESG – stands for Environmental, Social, and Governance and summarise a variety of factors that are financially material to businesses, and these include (but are not limited to):

|

Environmental

|

Social

|

Governance

|

|

|

|

From an investment standpoint, the integration of ESG within an investment strategy helps to form the foundation of what we term as ESG Investing. In general, due to its popular adoption by asset owners and managers, ESG investing has become synonymous with sustainable investing.

Sustainable investing has evolved to encompass both SRI and ESG Integration and can also be taken to mean several other strategies including:

- Negative Screening and Ethical Exclusions – The process of filtering out those companies that harm people or the planet. For instance, investors might exclude those related to arms, fossil fuels, tobacco and animal testing.

- Thematic and Impact Investment – Active and deliberate investment in assets due to their business purpose fulfilling a positive impact on society or environment, as is the case for example in renewable energy, clean technology and diversity and education, or investing toward the United Nations’ Sustainable Development Goals (SDGs).

- Responsible Investing – similar to sustainable investing in the sense of both being the allocation of capital to investments which are sustainable. In general, when one refers to one, they also mean the other.